Macro Security-Valuation Toolbox: Top-Down Valuation of Stock Indices

The purpose of the Macro-SVTbx is to help in surveillance and top-down valuation of the stock indexes for the purpose of macro-prudential and monetary policy. Using available data, the system aims to provide a distribution of the warranted value of the index, given the current and expected outlook of the economy.

I use two approaches, non-parametric and parametric. The non-parametric computes the present value of corporate profits based on long-term expectations survey for the United States. The parametric relies on a trend-cycle Bayesian model of the economy, see TC-BVARS [pdf].

Coverage:

Currently, the models are specified for the S&P-500, DAX-30, and EAFE, at quarterly frequency.

Methodology:

Examples:

I use two approaches, non-parametric and parametric. The non-parametric computes the present value of corporate profits based on long-term expectations survey for the United States. The parametric relies on a trend-cycle Bayesian model of the economy, see TC-BVARS [pdf].

Coverage:

Currently, the models are specified for the S&P-500, DAX-30, and EAFE, at quarterly frequency.

Methodology:

- The Present Value of Corporate Profits: A Forecasters' Survey Perspective [pdf] (IMF Working Paper, Nov 2019)-- in this paper I provide a valuation of U.S. corporate earnings based on consensus forecasts and analyze its dynamics and driving forces. The approach is suitable for policy institutions to follow in order to assess a warranted changes in asset prices consistent with their forecast.

- Simple Macroeconomic Model for Asset Pricing [pdf] -- in this paper I provide a simple structural model for valuation of U.S. corporate earnings and discuss alternative modeling approaches to do so.

Examples:

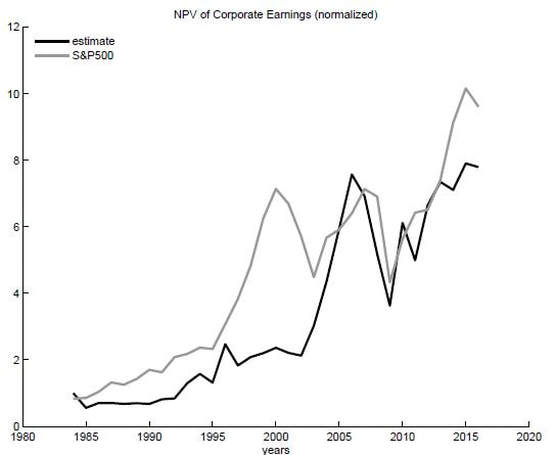

Fig. 1: S&P500 vs Present Value of Profits based on Bluechip Survey

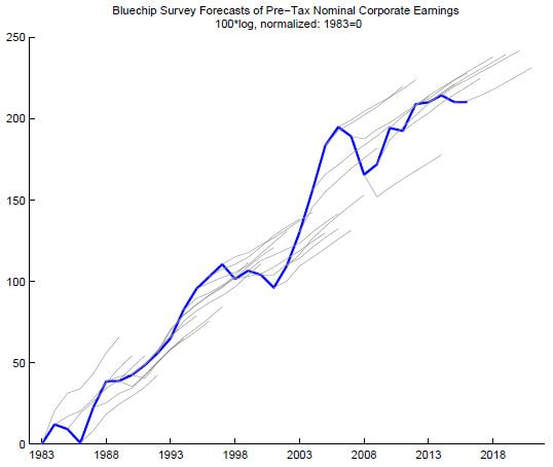

Fig. 2 -- Recursive Forecast of Nominal Corporate Earnings (Bluechip Survey)

DISCLAIMER:

The views expressed herein are those of the author and should not be attributed to the International Monetary Fund, its Executive Board, or its management. The toolbox is for private use and research purposes only, based on publicly available information.